Easy Loans Ontario: Simplified Approaches to Financial Support

Easy Loans Ontario: Simplified Approaches to Financial Support

Blog Article

Navigate Your Financial Trip With Trusted Finance Solutions Designed for Your Success

In the vast landscape of economic monitoring, the path to attaining your goals can often appear difficult and complicated. However, with the ideal assistance and assistance, navigating your economic journey can come to be a much more successful and workable undertaking. Reliable finance solutions tailored to fulfill your specific requirements can play a crucial role in this process, supplying an organized method to protecting the essential funds for your ambitions. By recognizing the complexities of different financing options, making educated decisions during the application process, and successfully taking care of payments, people can utilize car loans as calculated devices for reaching their economic milestones. Exactly how specifically can these solutions be enhanced to make sure long-lasting monetary success?

Recognizing Your Financial Needs

Comprehending your monetary demands is essential for making educated choices and attaining financial stability. By making the effort to analyze your monetary circumstance, you can recognize your long-lasting and temporary objectives, create a budget, and develop a plan to reach monetary success. Begin by examining your earnings, possessions, costs, and financial obligations to get a detailed understanding of your monetary standing. This analysis will help you establish just how much you can manage to save, invest, or allot in the direction of loan payments.

Furthermore, understanding your financial needs entails acknowledging the distinction between important costs and discretionary investing. Prioritizing your requirements over desires can assist you handle your financial resources better and prevent unnecessary financial obligation. Additionally, think about factors such as emergency situation funds, retirement preparation, insurance policy coverage, and future financial objectives when examining your financial requirements.

Checking Out Lending Choices

When considering your economic needs, it is vital to discover various finance alternatives available to identify one of the most ideal remedy for your specific situations. Comprehending the various sorts of car loans can aid you make educated decisions that straighten with your monetary objectives.

One common kind is an individual loan, which is unsecured and can be made use of for numerous objectives such as financial obligation consolidation, home renovations, or unanticipated expenses. Personal car loans typically have dealt with rate of interest and month-to-month settlements, making it simpler to budget plan.

One more choice is a protected car loan, where you offer collateral such as a cars and truck or building. Guaranteed financings usually feature lower rate of interest as a result of the minimized danger for the lender.

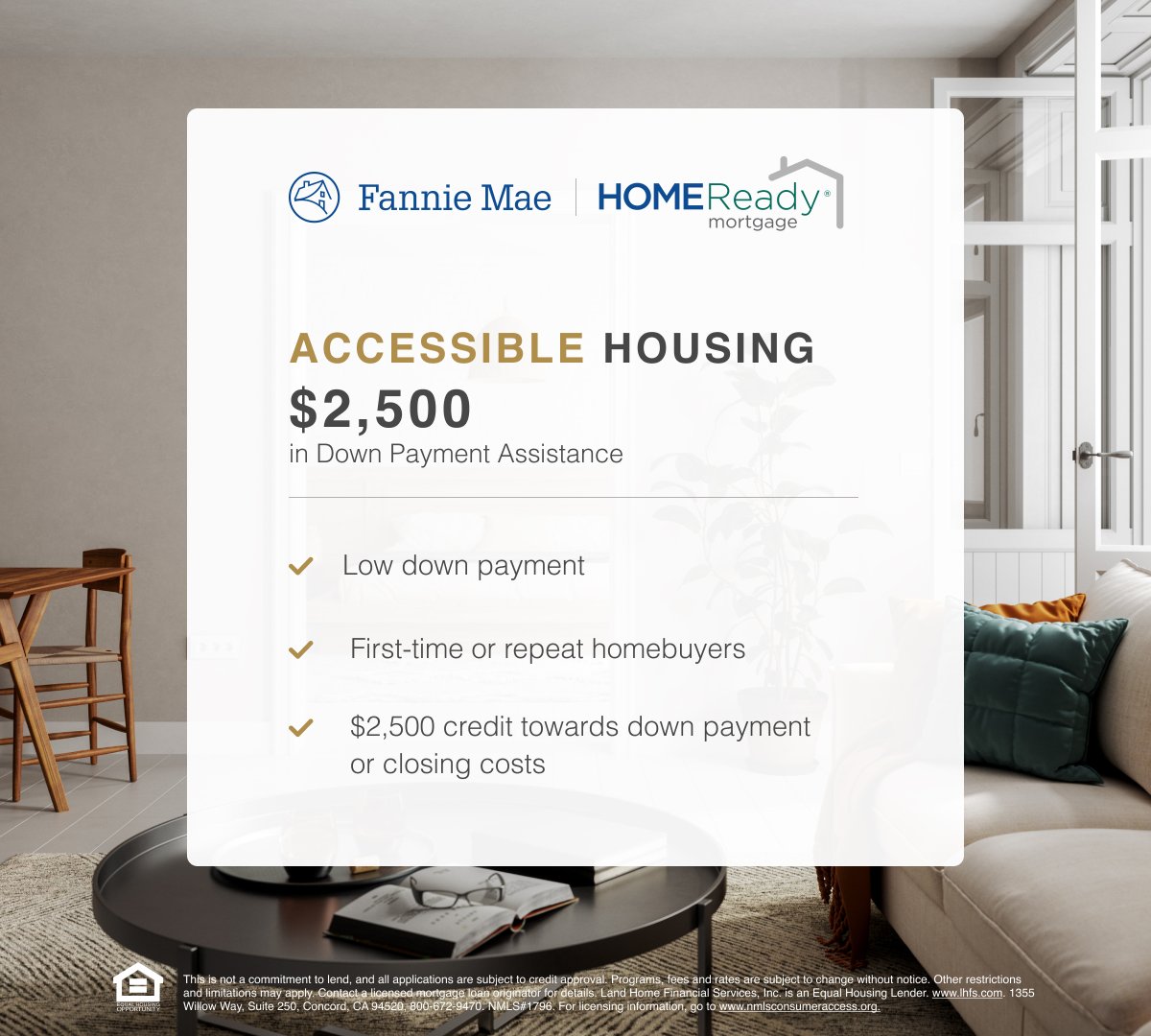

For those looking to purchase a home, a mortgage is a prominent choice. Home mortgages can differ in terms, interest prices, and deposit demands, so it's crucial to explore different lenders to discover the most effective suitable for your circumstance.

Getting the Right Funding

Navigating the procedure of requesting a car loan demands a comprehensive assessment of your economic requirements and thorough research right into the offered choices. Before you start the application procedure, it is important to comprehend your financial objectives and capacities (loan ontario). Begin by assessing the objective of the lending-- whether it is for a significant purchase, financial obligation consolidation, emergencies, or various other demands. This assessment will certainly aid you identify the finance amount needed and the settlement terms that align with your budget plan.

When you have actually recognized your economic demands, it's time to explore the funding items supplied by numerous lending institutions. Contrast rates of interest, payment terms, costs, and qualification requirements to discover the finance that finest matches your requirements. In addition, consider factors such as the lender's credibility, customer care high quality, and online tools for managing your lending.

When obtaining a finance, make certain that you supply precise and complete info to speed up the authorization procedure. Be prepared to submit documentation such as evidence of revenue, recognition, and monetary statements as required. By meticulously picking the appropriate financing and finishing the application carefully, you can set on your own up for monetary success.

Managing Lending Repayments

Reliable management of loan settlements is crucial for preserving financial security and conference your commitments properly. By plainly recognizing how much you can allot in the direction of loan repayments each month, you can make certain prompt settlements and stay clear of any monetary pressure.

If you come across troubles in making repayments, interact promptly with your lender. Numerous financial establishments supply options such as funding restructuring, deferment, or forbearance to assist borrowers facing financial obstacles. Ignoring payment issues can lead to extra charges, an unfavorable influence on your credit report, and possible lawful effects. Looking for assistance and checking out readily available solutions can help you browse with momentary monetary problems and stop long-lasting repercussions. By actively handling your finance settlements, you can preserve economic health and wellness and work towards attaining your long-lasting financial goals.

Leveraging Car Loans for Economic Success

Leveraging car loans purposefully can be an effective tool in attaining monetary success and reaching your lasting goals. When utilized intelligently, loans can give the necessary funding to purchase opportunities that might generate high returns, such as starting a service, pursuing college, or purchasing property. loans ontario. By leveraging financings, individuals can accelerate their Bonuses wealth-building process, as long as they have a clear prepare for settlement and an extensive understanding of the dangers entailed

One key element of leveraging loans for monetary success is to meticulously examine the terms and problems of the financing. Understanding the passion rates, repayment schedule, and any kind of associated charges is crucial to make certain that the lending lines up with your monetary goals. Furthermore, it's necessary to obtain only what you need and can reasonably afford to repay to avoid falling under a financial debt catch.

Final Thought

By comprehending the ins and outs of various look at here now financing options, making informed decisions throughout the application process, and efficiently handling payments, people can utilize financings as strategic tools for reaching their financial milestones. loan ontario. By actively managing your funding payments, you can keep economic wellness click here for more info and job towards accomplishing your long-term economic objectives

One key facet of leveraging lendings for financial success is to carefully analyze the terms and problems of the lending.In conclusion, recognizing your economic requirements, exploring lending options, using for the appropriate financing, handling funding repayments, and leveraging car loans for economic success are important actions in browsing your financial journey. It is crucial to thoroughly consider all facets of finances and monetary decisions to make sure long-term economic stability and success.

Report this page